Highlights

Balthazar launches LTI Program: Balthazar’s long-term scholar incentive program has been designed to provide their scholars with skin in the game, allowing them to gain exposure to Balthazar’s long-term success. Every Balthazar Wizard in the scholarship program, new and existing, will receive US$100 worth of Balthazar tokens. These tokens will vest after twelve months, which will encourage and reward long-term participation and value creation in our ecosystem.

Global Venture Capital firm, Side Door Ventures, has kicked off Balthazar’s new NFT lending platform, with $1 million of Splinterlands NFT assets. The VC, which is one of Balthazar’s backers in its Token Sale, has enlisted Balthazar to manage its 1.3 million Splinterlands NFTs to be used by Wizards through its scholarship program.

Product

Balthazar is a scholar-driven NFT gaming platform for the metaverse. It aims to have the most scholars deployed by managed NFTs and distribute them through our NFT gaming platform. Gamers get to access play-to-earn games with no upfront cost, supporting a fun and competitive ecosystem.

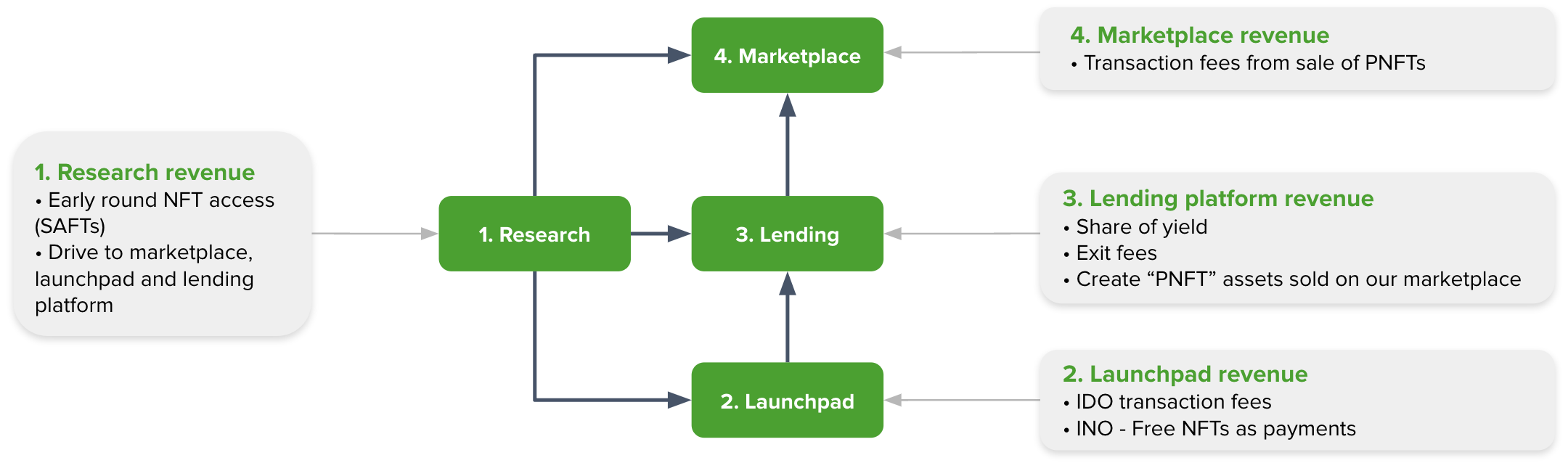

The NFT gaming platform focuses on four key pillars of commercialization.

Research

Research reports create thought leadership and demand for games to form relationships with Balthazar. A monetary byproduct is the opportunity to invest in games and NFTs at an early stage, generally at a steep discount to the public sale.

Launchpad

Games will be incentivized to launch on Balthazar’s launchpad due to our large community of scholars and investors. We will charge either a transaction fee or accept payment in the form of an NFT, which can then be sold.

Lending

The lend-to-earn feature where Balthazar uses its community of gamers to utilize investor’s NFTs, automating payment back to the investor, the scholar, and Balthazar. Balthazar supports the guild members through social networking, educational resources, and training and development around gameplay and learning cryptocurrency investment.

Marketplace

Our Marketplace is where investors can buy and sell pNFTs where by pNFTs are Balthazar’s unique solution to creating a marketplace for trading a portfolio of NFT assets attached to an ongoing scholar relationship.

Investors

Balthazar announced in January 2022 it had raised US$3.7 million in a token sale led by leading metaverse company Animoca Brands. Others investing in the round included Finder Group (through Hive Empire Capital, which is led by Fred Schebesta); ZipPay co-founder Larry Diamond; Digital Asset Capital Management (DACM); Fantom; ZED Run; Darling Ventures; Pluto Digital; San Francisco-based VC Side Door Ventures; Algorand; and Three Arrows Capital’s TPS Capital.

The capital raising valued the DAO at US$30 million.

In addition to Animoca Brands, Balthazar’s advisors include:

- Fred Schebesta: Business advisor World-famous entrepreneur, Founder of global fintech Finder, LinkedIn Top Voices of Australia 2020 and AFR Young Rich Lister.

- Brad Silver: Partnerships Crypto investor and strategist, former head of trading at Hive Empire Trading.

- Andrew Batey: Partnerships CEO of Beatdapp, a blockchain company that helps music labels and artists track their songs to collect royalties.

Team

John Stefanidis, CEO: Experienced online business expert, launching multiple seven-figure businesses including one eight-figure business in a five-year period.

Hairul Lutfi, CFO: Over 15 years of experience in accounting and compliance, specializing in fintech and fast-growth startups.

Bijan Abdollahi, COO: Skills and qualifications in engineering, business, and complex project development.

Kristian Bortnik, CTO: Deep information architecture (IA) and tech strategy skills, having managed large teams across multinational clients.

Peter Nay, CMO: Experienced in brand building, marketing and scaling e-commerce brands.

Terry Vogiatzis, CIO: Former Partner at one of Australia’s largest Wealth Management businesses and private cryptocurrency portfolio manager.

Nicholas Korsgård, CGO: E-Sports coaching phenomenon. A professional gamer at the highest level for both LoL and Starcraft.

Michelle Hutchison, CCO: Over 16 years experience in international media and communications, including digital marketing, cryptocurrency and fintech.

Jhun Salvino, General Manager: 10 years of management experience including working with global companies.

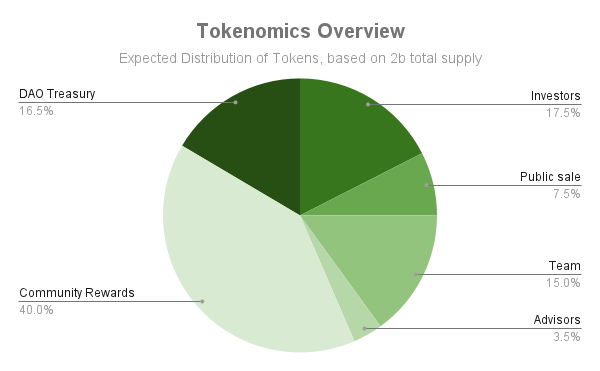

Tokenomics

Token Utility

Providing a tokenised exposure to the rapidly growing metaverse

Balthazar Bricks have designed to capture the value of all areas of the ever-growing Metaverse through a range of revenue-generating activities, allowing the token to grow in value in proportion to:

- The increase of NFT asset values

- The increase of our liquid treasury asset value

- Revenue derived by:

- Yield is retained when utilizing Balthazar’s scholars to play with third party investor’s assets (”lenders”)

- Yield generated by Balthazar’s NFT assets

- Exit fees incurred where lenders return their assets

- Transaction fees for lenders trading their pNFTs on our marketplace

- Transaction fees/NFTs earned for games using our launchpad

- Transaction fees earned for game IDOs

- Access to discounted valuations on early-round investments

- Gaming and eSports partnerships and sponsorships

Governance

Balthazar aims to be a fully Decentralised Autonomous Organisation. This means decision-making ultimately rests with our token holders rather than a centralised authority. In line with this objective, token holders will be given the opportunity to make and vote on various governance proposals.

Voting will occur through a portal where token holders are able to start proposals which will be voted on by other BRIX holders. The portal will also act as an open forum for members to discuss the various proposals.

Launchpad benefits

Balthazar token holders will be able to stake BRIX to receive a higher probability in receiving a randomised whitelisting/allocation to pre-launch games and tokens. A higher amount staked, along with a longer lockup period, will contribute to increasing your probability booster.

Premium dashboard

Staking $1,000 worth of Balthazar tokens will unlock a premium dashboard and allow lenders to be paid in stablecoins rather than in-game reward tokens.

The premium dashboard will provide an aggregated profit and loss across our launchpad and lending services.

Staking Rewards

Balthazar token holders will be able to stake their tokens in order to receive additional tokens. These tokens will eventually be funded by platform revenues, creating deflation and scarcity over the long term

Public price

Tokens $BRIX list to the public at around $0.25

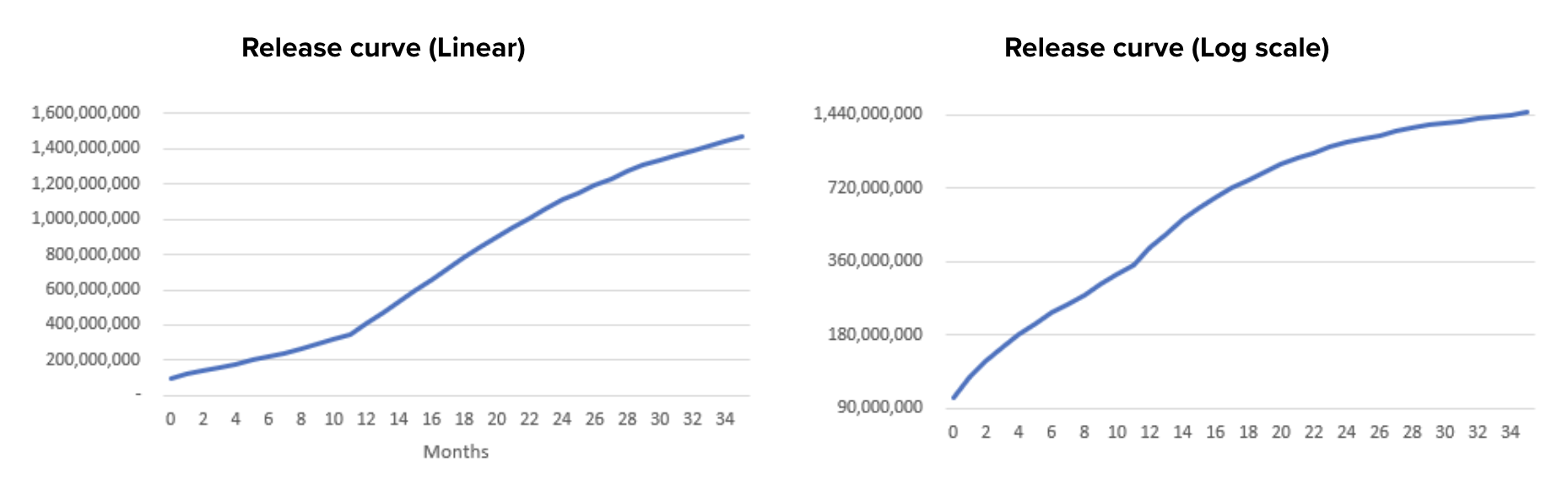

Vesting terms

TGE 0%, 9 months cliff, vest linear monthly in 12 months

References

- ‘Many are ready to quit their jobs to play NFT games’: Balthazar gaming guild CEO

- Animoca-backed Balthazar aims to be the Airbnb of the crypto gaming space after $3m raise

- NFT Gaming Platform Balthazar Raises US$3 Million via Token Sale Led by Animoca Brands

- Gaming platform Balthazar launch P2E NFT management platform

- BALTHAZAR RESEARCH: 1 in 3 willing to quit job to play NFT games

- Crypto gaming guild Balthazar adds to management team ahead of $8m token sale

- New NFT gaming platform Balthazar raises US$3 million in token sale